Get Matched With the Best HRIS/ATS Software, for Free!

Does researching HR Systems feel like a second job?

The old way meant hours of demos, irrelevant product suggestions, getting bombarded with cold emails and sales calls.

But there’s a better way.

With SelectSoftware Reviews, spend 15 minutes with an HR software expert and get 2–3 vendor recommendations tailored to your unique needs—no sales pitches, no demos.

SSR’s free HR software matching service helps you cut through the noise and focus only on solutions that truly fit your team’s needs. No guesswork. No fluff. Just insights from real HR experts.

Why HR teams trust SSR:

✅ 100% free service with no sales pressure

✅ 2–3 tailored recommendations from 1,000+ vetted options

✅ Rated 4.9/5 by HR teams and trusted by 15,000+ companies

Skip the old way—find your right HRIS/ATS in a new way, for free!

Welcome Note

Welcome back Gardeners!

Hopefully this will be the final time I ever have to mention this - but I am officially back on Linkedin from my OG account and by the end of July should hit 11,000 followers! You likely won’t see much from me in terms cannabis/THC as I don’t want to be banned again. But I am back!

David & I have been working hard on bringing you all a central location for the Podcast and a new website should be dropping soon. We will have educational resources, brand pages, and more. I will obviously keep you updated once it goes live!

The brand reviews over on the subreddit I moderate with Chris Fontes are still going and we are beginning to see more folks joining, we are closing in on 1,000 subscribers. So subscribe over on Reddit and follow along there!

The Free Spirits Podcast with David Gonzalez and myself is going strong and Episode 9 dropped last week featuring Joanne Caceres from Dentons. New episode drops on Monday!

If you could take the time to drop a review of the podcast or even just share it with a friend or two, it really does help us grow and continue to bring you this show.

I hope you enjoy this week’s newsletter

And as always, my email is open!

-Lars

Any comments or questions? Leave comment on this post or shoot me an email. Would love to hear from you!

Ten Thousand is dialed in on the essentials. Ultra-functional gear designed for real training. If you care about fit, feel, and focus, this is the brand.

Save 15% with code LMM15.

News Round Up

Senate Ag Appropriations Passes 27-0: But the Fight Isn’t Over

The Senate Appropriations Committee unanimously approved the FY26 Agriculture, FDA, and Rural Development Appropriations bill this week, and with it came language that could significantly restrict hemp-derived cannabinoids—including intoxicating hemp beverages. While the full impact of the language is still being analyzed, early interpretations suggest the bill may attempt to redefine hemp in ways that could have sweeping consequences for the beverage industry.

However, industry leaders are noting a potential legal vulnerability: Senate Rule 16 prohibits appropriations bills from making major policy changes without a direct tie to funding. Several observers believe the current bill oversteps that boundary, as it introduces regulatory shifts with no clear connection to appropriations. If that holds, it could provide grounds for a legal challenge and delay enforcement.

Still, the outlook remains uncertain. Even if this version of the bill stalls, there’s widespread concern it could resurface later this year as part of a continuing resolution (CR)—a legislative shortcut that could sneak in problematic language without the same level of debate or visibility.

If you’re looking for a way to help, contacting your elected officials today makes a difference. The U.S. Hemp Roundtable has created an easy-to-use portal for sending messages directly to lawmakers:

How THC Drinks Are Shaking Up Risk - Digital Insurance explores how the rise of THC-infused beverages is creating new challenges for insurers. Outlining key concerns around regulation, underwriting, and the need for updated frameworks to assess product liability and consumer safety.

Organigram Scales U.S. Presence with Collective Project Direct-to-Consumer Expansion - Organigram Holdings Inc. has announced a direct-to-consumer launch of its Collective Project THC beverages in select U.S. states. The expansion marks a strategic entry into the U.S. market following the brand’s success in Canada.

Introducing Mariona: A Tasteful THC Wine Alternative with a Flavor Worth Savoring - Mariona has launched as a new THC-infused wine alternative, available in California through licensed delivery services. The product is designed to offer a non-alcoholic option with a wine-inspired flavor profile and low-dose THC content.

📰 Got news? Submit it here! 📰

Any other questions or inquiries you can respond to this email or DM me on Twitter

Edibles that actually work. Shots that go where cans can’t.

1906 is rewriting the rules on how cannabis fits into your day.

Fast-acting, low-dose, and designed for effects you can trust—not guess at.

Who Really Drinks THC Beverages?

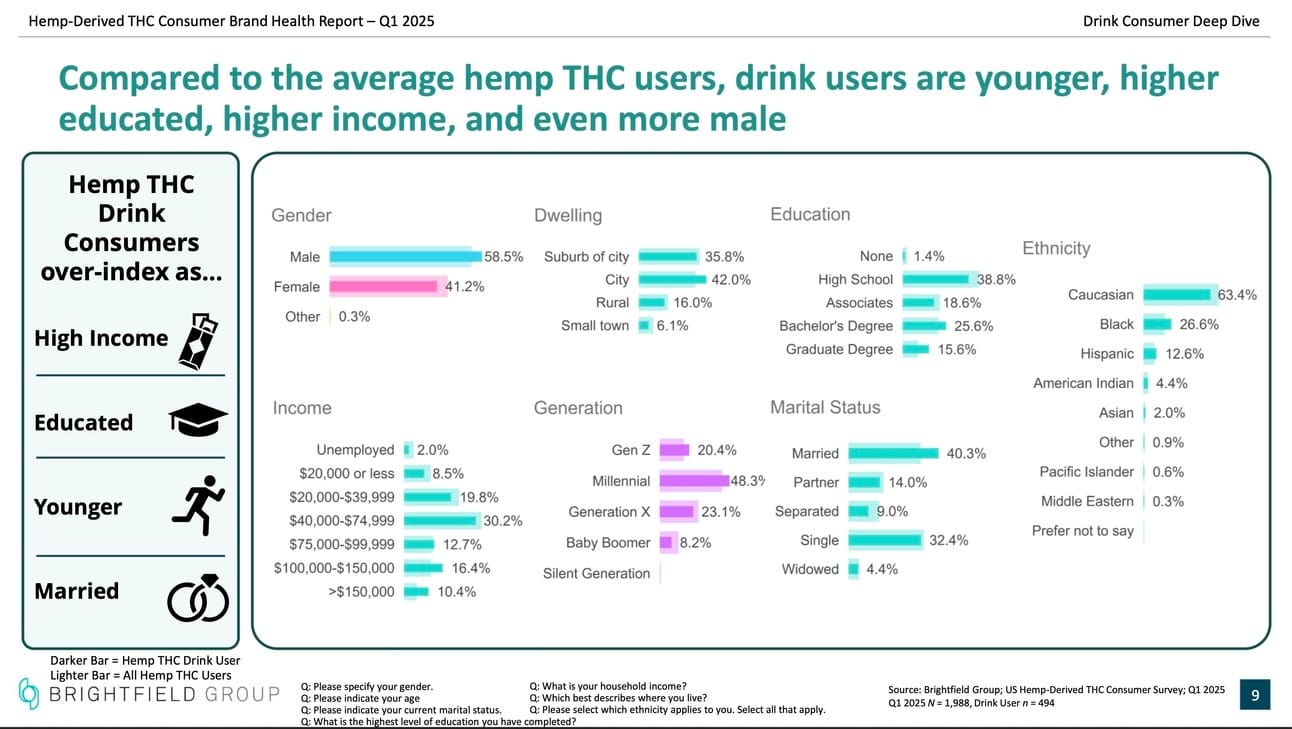

It’s easy to forget sometimes, living in our little THC/Hemp beverage world that there’s still a ton of stigma and immediate conclusions people make when you tell them you consume THC - no matter the format. When people think about THC, the immediate assumptions come quickly: stoners in hoodies, bros laughing and being lazy on the couch, etc. But the real data paints a different picture. According to Q1 2025 insights from Brightfield Group, the face of the hemp-derived THC beverage consumer is clear: high-income, educated, married millennial men living in urban or suburban areas.

This is a demographic that already drives premium wellness trends. They’re early adopters of wearables, biohacking protocols, and functional beverages. And now, they’re replacing alcohol with something that offers mental clarity, not a hangover. Cannabevs moved away from being a novelty awhile ago, they’ve been gaining real traction with consumers who value performance, precision, and control. Not to mention people who aren’t necessarily looking to go to the moon, but a very specific and balanced effect.

The Data-Backed Consumer Profile

The Brightfield Group’s Q1 2025 consumer study of nearly 2,000 respondents found that THC beverage users over-index as male, millennial, married, high-income, and highly educated. Among all hemp-derived THC users, drinkers skew even further toward the upper end of the income and education spectrum. And they’re not just trying drinks casually. Nearly half of THC drink users report using them weekly, with a notable increase in regularity quarter over quarter.

Compared to the overall cannabis market, where usage can be tied to either legacy behaviors or medical needs, THC drinks are being pulled into lifestyle routines. These consumers aren’t necessarily trying to get high. They’re trying to relax, reset, or replace other substances.

Building New Rituals

One of the most compelling confirmations of this changing behavior comes from Brēz (shoutout Daniel Crocker for sharing the data in his newsletter), a social tonic that combines microdoses of THC and CBD with Lion’s Mane mushroom. In a 22-day clinical study and 90-day follow-up, Brēz users showed dramatic changes in daily behavior and well-being:

73% reduction in alcohol consumption

67% reported reduced stress

56% improved mood

54% better sleep quality

44% reported sharper focus

83% preferred Brēz over alcohol for social and health reasons

Even more telling: 96% of participants reported using Brēz 4–6 times per week, and 83% reported daily use. That’s building a new ritual.

These aren’t consumers browsing the CBD aisle once and moving on. They’re forming habits. The product is working not as a replacement, but as a better version of a routine they already had, a wind-down drink, a focus enhancer, a mood stabilizer. Brēz’s proprietary formulation and rapid onset (5–10 minutes thanks to micronization) likely play a role in this behavioral stickiness.

The Appeal of Controlled Intoxication

This demographic wants to feel something, just not too much. Brightfield found that most drink users prefer 5–9mg per serving, though use of 2–4mg doses is rising steadily. It’s taking time, but slowly consumers are beginning to come around to wanting to consume a couple of drinks in a sitting. Or using spirits to create a dose that works for them over time.

There’s a broader consumer trend happening right now, where consumers are moving away from intoxication and seeking very intentional experiences that allows them to operate at peak capacity every day. The same cohort fueling growth in THC beverages is also powering the boom in non-alcoholic cocktails, adaptogen drinks, and microdosing protocols. The goal is for personal improvement and social fun, not escaping.

In that context, Brēz’s outcomes make sense. A product that delivers relaxation, mood regulation, and mental clarity without the downside of alcohol fits neatly into this consumer’s goals.

Retail Implications

This demographic also shops differently. While hemp and vape shops still dominate as sales channels, Brightfield reports that purchases at liquor stores and bars have climbed substantially year-over-year. THC drinks are becoming more socially acceptable, and more desirable in traditional adult beverage spaces.

That opens up new opportunities for retail partnerships and placement. The high-income, high-frequency drinker is someone who might browse a craft beer fridge, a premium mixer section, or a boutique wellness display. Retailers that group these products with energy drinks or supplements are likely missing the mark.

However, while these consumers are continuing to move away from alcohol in some capacity, that doesn’t mean they are entirely quitting. It’s important with your messaging that you don’t alienate these consumers.

Why This Matters for Investors and Retail Buyers

For investors, this is a category with growing traction among an audience that spends, experiments, and talks. Brightfield’s forecast suggests that the hemp-derived THC market will reach $3.8B in 2025, and beverages are the fastest-growing segment. For retail buyers, this is a signal to allocate shelf space not just based on THC percentage or can design, but based on buyer behavior and brand loyalty.

Brands that lead with scientific validation, clear function, and ingredient transparency are winning the trust of the most brand-discerning customers in the space. And as regulatory conversations heat up, products that already align with responsible usage patterns will be better positioned for long-term distribution. Your messaging must be crystal clear and you need to deliver on your effects.

On a recent episode of The Free Spirits Podcast Ben Larson discussed this, folks are seeking mood-modulation. And being able to deliver that consistently is how brands will win consumer share.